Cash for Homes in Delaware County Buyers – Will I Get A Fair Price?

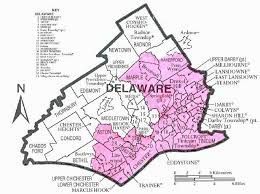

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA.

Let’s explore how you can sell your local Delaware County house quickly and get cash without having to list your house with a real estate agent or wait months for it to sell.

How Do Cash for Homes in Delaware County Buyers Work?

Finding reputable local Delaware County house buyers who pay cash for homes can be challenging. However, with some research, you’ll find several investors ready to buy properties for cash. Here are some key things to consider when working with local cash home buyers (including our company, Barb Buys Houses).

If you’re unsure how the process works, check out our “How it Works” page and FAQ.

Price and Time Are Trade-Offs – Which Is More Important to You?

Getting the full market value for your home when selling it fast for cash can be difficult. To get the full value, you might need to wait 3-6+ months and work with a real estate agent, who charges a commission (usually 3-6% of the sale price). So, if it takes six months to sell and you pay a 5% commission, is that wait worth it?

Local Delaware County house buyers like Barb Buys Houses will evaluate your house, determine its worth if fully fixed up, and calculate the investment needed for repairs and renovations. Of course, we need to make a small profit for our risk in buying, renovating, and selling the house, so our offers are often below full retail market value.

But we can close quickly (in as little as 7 days if needed). If selling your house fast with zero hassle is more important than getting every penny, submit your info on the form on this next page or call us at (215) 375-4433.

We can make you a fast, no-hassle offer in less than 24 hours.

We ensure every house seller we work with knows all their options and encourage you to get other offers and shop around. We won’t always offer the lowest price, nor the highest, but we follow through on what we promise.

How Much Work Do You Want to Put Into Selling Your Delaware County PA House?

Another significant advantage local Delaware County cash home buyers like Barb Buys Houses offer is handling 100% of the work and hassle of selling your house.

We manage everything.

We’re not listing your house like an agent. With an agent, you’d need to clean up, show it to potential buyers, negotiate through your agent, etc. It can be a lot of work, especially if your house in Delaware County needs repairs.

We offer cash for houses in Delaware County, PA, because we’re professional home buyers based locally. If your house needs work, we’ll buy it as-is and cover the repair costs ourselves. We also handle all the paperwork, using a reputable, neutral closing agent in town, or one we recommend.

We can make you a fair all-cash offer on your Delaware County house (or call us today at (215) 375-4433. If it’s a fit, great! We’ll handle everything.

Do Your Research and Trust Your Gut

Before deciding on an investor offering cash for your property, investigate their reputation carefully. Ask for references and speak to past clients to ensure they’re the right fit for you.

There are dishonest people out there, so make sure to do your research, talk to the investor, and ensure you trust them and that they can close on the offer they made you on time.

We take our reputation seriously and are happy to answer any questions you have about us, the process, and how we can help you.

When you’re ready to start the process of selling your Delaware County, PA home for cash, fill out our form, and we’ll help you get started.

Call Barb Buys Houses today at (215) 375-4433 for an immediate cash offer on your Delaware County, PA house, or submit the Fast Offer Form here >>

BROWSE

ABOUT

CONTACT US

HomeSmart Realty Advisors Philadelphia

The Dream Team 1

2424 East York Street, Suite 213

Philadelphia, PA 19125

LICENSE: RS374975

home@armandgjeka.realtor

We are committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, notice any accessibility problems or should you require assistance in navigating our website, please contact us.

All Rights Reserved | Website Powered by HomeSmart Realty Advisors Philadelphia

All Rights Reserved | Website Powered by National Association of REALTORS®