October Events in Philadelphia 2024

September 4, 2024

October Events in Philadelphia 2024

New Age Realty Group, Inc.

September 4, 2024

DesignPhiladelphia Festival

October (215) 375-4433, 2024

October (215) 375-4433, 2024

Celebrating its 20th anniversary, DesignPhiladelphia is a 13-day fest highlighting the city’s design excellence, the skills of local designers and the impact of design on everyday life, held at sites across the city including home venue Center for DesignPhiladelphia (formerly Center for Architecture and Design). The event draws thousands to nearly a hundred (mostly free) exhibitions, lectures, workshops and demonstrations representing scores of artists, professionals and students in practically every design discipline like product and interior design, graphic design, architecture, multimedia, automotive, urban planning and much more.

Where: Various locations including Center for DesignPhiladelphia, 1218 Arch Street More info here

Spooky Mini Golf in Franklin Square October (215) 375-4433, 2024

Where: Various locations including Center for DesignPhiladelphia, 1218 Arch Street More info here

Spooky Mini Golf in Franklin Square October (215) 375-4433, 2024

Philly Mini Golf at historic Franklin Square transforms into Spooky Mini Golf, featuring 18 holes of eerie lights, haunting music and scary surprises under the cover of a spooky fog. Tickets are required for the Center City miniature golf course, which features Halloween décor across its greens dotted by famous Philly landmarks like the LOVE sculpture, Elfreth’s Alley, the Chinatown Friendship Gate and Boathouse Row.

Where: Franklin Square, 200 N. 6th Street More info here

Roxtoberfest 2024 in Roxborough Saturday, October 5, 2024 | (215) 375-4433 p.m.

Where: Franklin Square, 200 N. 6th Street More info here

Roxtoberfest 2024 in Roxborough Saturday, October 5, 2024 | (215) 375-4433 p.m.

Head up to Philly’s Roxborough neighborhood to join in the 12th annual Roxtoberfest free street festival. Hit the hills for a massive celebration along Ridge Avenue, including German-themed entertainment and competitions, food trucks, live music, costumed pets, activities for the kids and plenty of beer for the adults, plus more over 100 local crafters, artists, makers and community organizations. New for 2024 is the Scarecrow Walk in Gorgas Park, where attendees can stroll the block, snap selfies with their favorite field guardians and vote for the best scarecrow creation (and even create their own).

Where: Ridge Avenue between Lyceum Avenue and Leverington Avenue More info here

Southeast Asian Market in FDR Park Saturdays & Sundays through October 27, 2024

Where: Ridge Avenue between Lyceum Avenue and Leverington Avenue More info here

Southeast Asian Market in FDR Park Saturdays & Sundays through October 27, 2024

Enjoy one of the best food markets in the United States as the seasonal Southeast Asian Market wraps up at FDR Park. The massive culinary treasure includes over 70 vendors offering traditional dishes, street food, native produce, plants, jewelry, apparel and more, set up in the (appropriately) southeast corner of the park. Bring a picnic blanket and enjoy your food fresh along with your take-home haul. Note: Some vendors are cash-only and there’s no ATM on site.

Where: Southeast Asian Market, 1500 Pattison Avenue More info here

Where: Southeast Asian Market, 1500 Pattison Avenue More info here

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

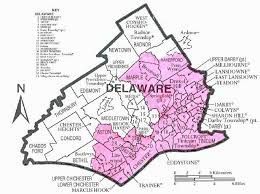

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued