Choosing Between Renting a House or an Apartment

April 22, 2024

Choosing Between Renting a House or an Apartment

New Age Realty Group, Inc.

April 22, 2024

Deciding whether to rent a house or an apartment is a decision that hinges on a variety of factors including lifestyle preferences, budget constraints, and long-term living arrangements. In Philadelphia, a city with a diverse range of housing options, this choice becomes particularly pronounced. The decision to opt for a home or an apartment affects daily life, financial commitments, and personal comfort. It’s important to understand the differences between renting a house and an apartment to make an informed decision.

Understanding the Housing Market in Philadelphia

Philadelphia's housing market presents a plethora of options ranging from modern high-rise apartments in bustling Center City to charming row houses in neighborhoods like Fishtown and Manayunk. Each option offers distinct advantages and challenges, shaped by factors such as location, pricing, and amenities.

Apartment Living in Philadelphia: Pros and Cons

Pros:

Cons:

House Rentals in Philadelphia: Pros and Cons

Pros:

Cons:

Financial Considerations for Renting in Philadelphia

When deciding whether to rent a house or an apartment in Philadelphia, understanding the financial implications is critical. This decision not only affects your monthly budget but also impacts your financial flexibility and planning. Here, we delve deeper into the costs associated with each option to give a clearer financial perspective.

Budget Alignment and Monthly Costs

Apartments: Generally, apartments in Philadelphia are considered a more budget-friendly option, particularly attractive to single professionals, couples, and small families. The reasons include:

Houses: Renting a house often appeals to larger families or those planning a long-term stay. Financial considerations include:

Initial and Recurring Costs

Initial Costs:

Recurring Costs:

Long-Term Financial Implications

Flexibility vs. Stability:

Lifestyle Implications

Choosing between an apartment and a house significantly impacts one's lifestyle. Apartments in lively urban areas can enhance social life and reduce commute times, which is a boon for young professionals. Conversely, houses are often more suited to families or those who appreciate a quieter, more settled environment.

Long-Term Perspectives

Renting a house may offer the opportunity to transition to homeownership through rent-to-own arrangements, appealing to those considering purchasing in the future. Apartments, while less likely to offer this pathway, provide greater flexibility, allowing renters to move swiftly should their circumstances change.

Whether to rent a house or an apartment boils down to individual needs, financial capacity, and lifestyle preferences. Apartments offer convenience and a bounty of amenities but may come with higher costs and less privacy. Houses provide more space and flexibility but often at a higher price and with more maintenance responsibilities. Potential renters should consider their priorities and consult widely to make the best choice for their living situation, balancing the pros and cons of each option against their personal and financial circumstances. The decision profoundly impacts daily living and financial health, making it crucial to approach with careful consideration.

Contact New Age Realty Group to help you with all your real estate needs! For our current rentals, click here .

Understanding the Housing Market in Philadelphia

Philadelphia's housing market presents a plethora of options ranging from modern high-rise apartments in bustling Center City to charming row houses in neighborhoods like Fishtown and Manayunk. Each option offers distinct advantages and challenges, shaped by factors such as location, pricing, and amenities.

Apartment Living in Philadelphia: Pros and Cons

Pros:

- Affordability: Generally, apartments are cheaper to rent than houses. This can be particularly advantageous for singles, couples, or small families looking to save money.

- Amenities: Many apartment complexes offer amenities that houses typically do not, such as gyms, pools, laundry facilities, and 24-hour security.

- Maintenance: Maintenance responsibilities are usually minimal for renters, as landlords or property management typically handle everything from repairs and landscaping.

- Utility Costs: Apartments are often more compact and can be cheaper to heat and cool than a larger house.

Cons:

- Space Limitations: Apartments can be restrictive in terms of space, both indoors and outdoors, which can be a significant drawback for large families or people with pets.

- Noise and Privacy: Living in close proximity to others can increase the likelihood of noise disturbances. Apartments often offer less privacy than houses due to the close quarters and shared common spaces.

- Parking: Depending on the location, parking can be limited or expensive.

House Rentals in Philadelphia: Pros and Cons

Pros:

- Space: Houses typically provide more space—both inside and outside—than apartments, which is ideal for families, pet owners, or those who entertain frequently.

- Privacy: A house generally offers more privacy than an apartment, with fewer worries about noisy neighbors.

- Community: Houses are often located in residential neighborhoods that offer a sense of community and stability.

- Amenities:

Some houses come with their own unique amenities like private yards, basements for storage, and garages.

Cons:

- Cost: Renting a house can be more expensive than an apartment. This includes higher rent and utilities.

- Maintenance: Renters of houses might be responsible for maintaining the yard and other aspects of the property.

- Location: Houses for rent might be located further from city centers and amenities than apartments.

Financial Considerations for Renting in Philadelphia

When deciding whether to rent a house or an apartment in Philadelphia, understanding the financial implications is critical. This decision not only affects your monthly budget but also impacts your financial flexibility and planning. Here, we delve deeper into the costs associated with each option to give a clearer financial perspective.

Budget Alignment and Monthly Costs

Apartments: Generally, apartments in Philadelphia are considered a more budget-friendly option, particularly attractive to single professionals, couples, and small families. The reasons include:

- Lower Rent: Typically, the monthly rent for apartments, especially those outside the luxurious high-rise buildings, is more affordable than house rentals. This difference can be significant, depending on the neighborhood and apartment size.

- Utilities Included: Many apartments offer utilities included in the rent. This can cover water, trash, and sometimes even heating, which simplifies budgeting and can save money during colder months.

- Smaller Space, Lower Utility Bills: Apartments usually have a smaller footprint, which means lower costs for heating, cooling, and electricity, even if these are not included in the rent.

Houses: Renting a house often appeals to larger families or those planning a long-term stay. Financial considerations include:

- Higher Rent: Houses generally command higher monthly rents. This is due to increased space, privacy, and the additional amenities such as yards and garages.

- Higher Utility Costs: Homes typically incur higher utility bills, including gas, electricity, water, and maintenance. These costs can fluctuate significantly with the seasons, particularly in Philadelphia’s variable climate.

- Maintenance and Upkeep: Unlike most apartments, many houses do not include maintenance in the rental agreement. Renters might be responsible for lawn care, minor repairs, and other upkeep tasks, which adds to the monthly expenditure.

Initial and Recurring Costs

Initial Costs:

- Security Deposits: Both apartments and houses usually require security deposits, but those for houses can be substantially higher. This is often equivalent to one or two months' rent, depending on the landlord's policy and the property's value.

- First Month’s Rent: Common to both apartments and houses, paying the first month’s rent upfront is standard practice.

- Application Fees: These are more common in apartments, particularly in managed complexes. Fees cover the cost of background and credit checks.

- Advance Payments: Renters of houses may be asked to provide a larger deposit or advance payments, especially if they have pets or if the property is particularly upscale.

Recurring Costs:

- Rent Increases: Philadelphia's rental market may experience fluctuations, and renters should anticipate potential annual increases in rent for both apartments and houses. These can be influenced by market trends, property upgrades, and changes in neighborhood desirability.

- Insurance: Renters' insurance is generally advisable for both options but might be higher for houses due to the greater value of the property and possessions.

- Community Fees: Some residential areas, particularly those with shared amenities like parks or swimming pools, might charge additional homeowner association (HOA) fees, which is more common in house rentals.

Long-Term Financial Implications

Flexibility vs. Stability:

- Apartments offer greater flexibility with typically shorter lease terms, which is beneficial for those who may need to move frequently for work or personal reasons. This flexibility can be a financial advantage if relocation is necessary or if personal circumstances change.

- Houses provide more stability, which is ideal for families looking to establish roots in a community. Longer lease terms and the potential for rent-to-own agreements can offer a pathway to homeownership, which is financially beneficial in the long term.

Lifestyle Implications

Choosing between an apartment and a house significantly impacts one's lifestyle. Apartments in lively urban areas can enhance social life and reduce commute times, which is a boon for young professionals. Conversely, houses are often more suited to families or those who appreciate a quieter, more settled environment.

Long-Term Perspectives

Renting a house may offer the opportunity to transition to homeownership through rent-to-own arrangements, appealing to those considering purchasing in the future. Apartments, while less likely to offer this pathway, provide greater flexibility, allowing renters to move swiftly should their circumstances change.

Whether to rent a house or an apartment boils down to individual needs, financial capacity, and lifestyle preferences. Apartments offer convenience and a bounty of amenities but may come with higher costs and less privacy. Houses provide more space and flexibility but often at a higher price and with more maintenance responsibilities. Potential renters should consider their priorities and consult widely to make the best choice for their living situation, balancing the pros and cons of each option against their personal and financial circumstances. The decision profoundly impacts daily living and financial health, making it crucial to approach with careful consideration.

Contact New Age Realty Group to help you with all your real estate needs! For our current rentals, click here .

By armand.gjeka

•

October 6, 2024

Buying your first home can be an exciting yet overwhelming process, especially when it comes to finding ways to make it affordable. Fortunately, there are several grants and assistance programs available for first-time homebuyers in Pennsylvania that can help make homeownership a reality. These programs offer financial aid in the form of grants, closing cost assistance, and down payment help. Below is a list of grants and assistance programs currently available to first-time buyers in Pennsylvania: Grants and Assistance Programs Available in PA Pennsylvania Housing Finance Agency (PHFA) Keystone Advantage Assistance Loan Program Provides up to $6,000 as down payment or closing cost assistance. Available for borrowers with a PHFA first mortgage. HOMEstead Downpayment and Closing Cost Assistance Loan Offers up to $10,000 in down payment and closing cost assistance. Loan is forgiven over a five-year period, provided the homeowner stays in the home. K-FIT (Keystone Forgivable in Ten Years Loan Program) Provides up to 5% of the lesser of the purchase price or appraised value as down payment and closing cost assistance. Forgiven over ten years, with no repayment required if eligibility requirements are met. FHA, USDA, and VA Loan Programs Offer down payment assistance and more lenient credit requirements. PA-based grant programs can often be paired with these loan types for added affordability. First Front Door Program Offers a grant of up to $5,000 to qualified first-time homebuyers. You must match the grant with your own savings; for every $1 you contribute, $3 is provided. For more detailed information on these grants and eligibility requirements, visit the Pennsylvania Housing Finance Agency (PHFA) website . These programs can help you bridge the gap between renting and owning by providing essential financial assistance. Whether you need help with a down payment or closing costs, there is likely a program to fit your needs as a first-time homebuyer in Pennsylvania. More Grants and Assistance Programs for First-Time Buyers in PA In addition to the Pennsylvania Housing Finance Agency programs, several other grants and assistance programs are available from different agencies and organizations, providing even more opportunities for first-time homebuyers in Pennsylvania: Community Development Block Grant (CDBG) Program Funded by the U.S. Department of Housing and Urban Development (HUD). Provides funding to local governments for affordable housing initiatives, including down payment assistance for low- to moderate-income first-time buyers. Availability and amount vary by municipality, so check with your local city or county government for opportunities. Neighborhood Assistance Program (NAP) Offers tax credits to businesses that invest in affordable housing initiatives, which can help first-time buyers indirectly by funding community housing projects. This program is administered through the Pennsylvania Department of Community and Economic Development (DCED). Federal Home Loan Bank (FHLB) Affordable Housing Programs The First Front Door (FFD) program, offered through FHLB, provides eligible first-time buyers with a grant of up to $5,000 to assist with a down payment and closing costs. Participating lenders and financial institutions provide the funding, so buyers need to work with a participating bank. Local Housing Authorities Various local housing authorities across Pennsylvania offer down payment assistance programs and grants. Examples include the Philadelphia Housing Development Corporation (PHDC), which offers the Philly First Home program that provides up to $10,000 (or 6% of the home purchase price) to assist first-time buyers with down payments and closing costs in Philadelphia. U.S. Department of Agriculture (USDA) Loans and Grants The USDA offers loans and grants to promote homeownership in rural areas of Pennsylvania. Eligible buyers can receive 100% financing, and grants can help cover closing costs or home repairs. Good Neighbor Next Door Program (HUD) This HUD program offers a 50% discount on the list price of a home for teachers, law enforcement officers, firefighters, and emergency medical technicians in designated revitalization areas. Buyers must commit to living in the home for at least 36 months. Housing Counseling Agencies Non-profit agencies in Pennsylvania, like NeighborWorks America affiliates, may offer grants or forgivable loans to assist with down payments or closing costs. These agencies often provide educational courses, which can be a requirement for qualifying for other grant programs. For more information, visit: Pennsylvania Department of Community and Economic Development (DCED) Philadelphia Housing Development Corporation (PHDC) Federal Home Loan Bank (FHLB) With a combination of state, federal, and local grants, first-time buyers in Pennsylvania can save up to $31,000 or more. Whether you're looking to reduce down payment costs, get closing cost assistance, or find affordable financing options, these programs are designed to help make your dream of homeownership come true. Authored by: Armand Gjeka, Realtor Sources: -https://phdcphila.org -https://www.phfa.org -https://dced.pa.gov/ -https://www.fhlb.com/

By Barb Berue

•

September 3, 2024

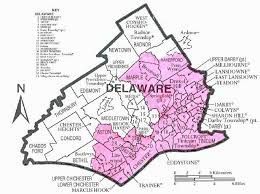

If your Delaware County, PA house is facing foreclosure and you want to avoid it, or if you just need to sell your house quickly for another reason (such as inheriting a house, relocating, losing your job, or if your agent can’t sell your house), then finding a buyer to purchase your Delaware County PA … Continued

By Barb Berue

•

August 27, 2024

Time and money are crucial factors when you are selling your home. If you need to sell your Delaware County house fast, there are local professional home buying companies who pay cash for homes in Delaware County, PA. Let’s explore how you can sell your local Delaware County house quickly and get cash without having … Continued

By Barb Berue

•

July 30, 2024

Foreclosure is a difficult and overwhelming experience for any family facing it, regardless of the reasons behind the situation. Today, we will explore the effects of foreclosure in Delaware County, PA, and what local homeowners should be aware of. We’ll discuss both the impacts of foreclosure and ways to mitigate them. Foreclosure Effects in Delaware … Continued

BROWSE

ABOUT

CONTACT US

HomeSmart Realty Advisors Philadelphia

The Dream Team 1

2424 East York Street, Suite 213

Philadelphia, PA 19125

LICENSE: RS374975

home@armandgjeka.realtor

We are committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, notice any accessibility problems or should you require assistance in navigating our website, please contact us.

© 2025

All Rights Reserved | Website Powered by HomeSmart Realty Advisors Philadelphia

© 2025

All Rights Reserved | Website Powered by National Association of REALTORS®